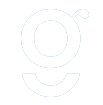

One of the fundamentals of community management is the HOA accounting. As a Board Member, you may or may not have a background or experience in reading and understanding financial reports. Here are some things every board member should know about HOA Accounting.

Follow Best practices

First, a segregation of duties between three essential areas: Accounts Receivable, Accounts Payable, and General Ledger, increases efficiencies, allows for checks and balances, and greatly reduces the risk of fraudulent activity. For example, you would not want the same person who receives the association’s revenue to then write your Association’s checks. All work should ideally be overseen and reviewed by a Certified Public Accountant (CPA). Select an outside source to audit the association’s records.

Financial Reports

Essential reports include a Budget Variance Report & Income Statement, Balance Sheet, Check Register, Bank Reconciliation Report, Prepayments & Credits Report, and Aging Report. You may request other custom reports, but these reports are the basics that you need as a Board Member to make sound decisions for your association. The reports should be delivered to you in time for you to review them before the meeting – ideally seven days before your Board meeting. Your Manager will report about significant variances at the meeting or detail these stand-outs in the management report.

Communication is Key

Much of the accounting administration depends on your decisions as a Board Member. If you table an approval for several months, your Manager should communicate with the vendor about the pending payment and resolve any outstanding issues as soon as possible. If there is a need for a special assessment, communicate that clearly and often to your membership, and involve accounting from the beginning to ensure proper set-up of accounts. Don’t understand your financials? Ask your Manager for more information or set-up a meeting with your accounting team.

Details Matter

Associations are non-profit organizations, so the fiscal year-end budget should net $0. Transfer excess operating funds to reserves when possible, and watch the FDIC limits on your accounts. Know if you are accounting on a cash basis, accrual or modified accrual, and familiarize yourself with the method. Each state may have varied regulations regarding the accounting and financials for your Association. Your professional management service provider is the best source for guidance.

- Top 3 Bad Board Decisions - May 15, 2019

- To Host or Not To Host? - September 5, 2018

- 4 HOA Accounting Principles Board Member Should Know - November 1, 2017

Help

Help

Hello…

I belong to an HOA that is making a major purchase (over $40,000) and refuses to get a second bid on the project. Are there accounting rules that they should be required to get at lease a second bid?