If you’re considering buying a home in a condo or HOA community, chances are you have some preconceived ideas about what that means. Some of those ideas may be true and some may not. The truth is, every community is unique, with a different set of benefits, problems, and rules that affect how you enjoy your new home.

So, what do you really need to know, and how can you find out before it’s too late?

Understanding the HOA Community

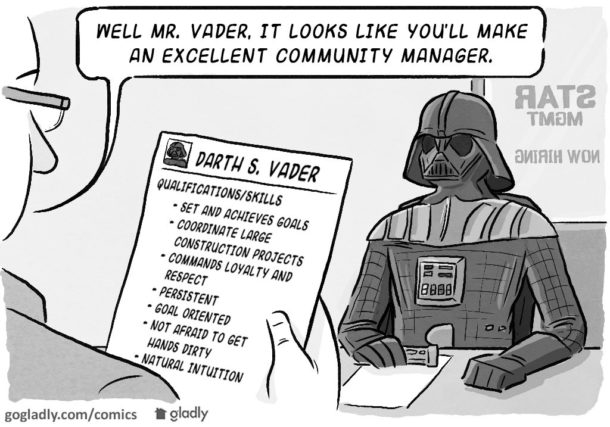

Many people buy a home with little or no understanding of what the HOA is, how it works, and what is expected of them. Remember an association is an organization operated by a board of elected owners who oversee maintenance of the common area, enforce rules, and uphold architectural standards. By participating and volunteering you can help your community be great.

Now if you’re “that guy” who says, “I can do anything I want, ain’t nobody gonna tell me what I can and can’t do!” Well… maybe living in a community association isn’t for you.

But if the idea of sharing costs for common amenities — like a pool or clubhouse — seems like a good idea, and you’re willing to accept some rules to limit the negative impact one person can have on another — You may want to consider living in a community with a HOA.

What Does it Cover?

The difference between a home with an HOA and one without, is that in an HOA community some of the maintenance costs are shared, and collected up front. Many people don’t realize how much they spend on lawn care or how much it will cost when their roof needs replacement. In an HOA these cost are calculated and collected up front to make sure these items are properly maintained.

As part of your due diligence, review the budget, talk with community leaders and find out what’s covered by HOA dues. Knowing what’s covered can help you determine if the HOA dues are a good value.

Know The Rules

The HOA rules are outlined in the governing documents and defined by policies and procedures adopted by the HOA board. It’s always wise to read this 50 page riddle called your (covenants conditions & Restrictions) CC&R’s, but to really know the rules, I recommend asking HOA community leaders about specific rules especially when it comes to pets, home modifications, parking, and dispute resolution. Many associations have a summary of the rules. A rule summary will usually outline the most commonly broken rules and the rules that are important to the association and its members.

Recognize the Red Flags

Despite their reputation, most HOA are pretty good and most owners are happy with their HOA. But… as with just about everything there are some bad apples. The trick is — is to avoid these bad apples. Here are some red flags to watch for.

- Talk to the neighbors: Take a walk around the neighborhood and chat with neighbors. You’ll be surprised how willing they are to tell you about their feeling on the community. If you sense contention between neighbors and the HOA this could be a bad sign. But don’t rule out a home because of one bad HOA review.

- Difficulty or resistance getting information: As you perform your due diligence you will most likely be in touch with the manager or community leader. They should be able to answer your questions and provide financial statements and other documents in a reasonable amount of time without too much trouble. Check out their website. Do they have a website? Is it up-to-date and accurate? Trouble in these areas can be a sign of poor organization and communication. Most HOA problems start because of inconsistencies due to poor organization and communication.

- Reserves: Are they funding a reserve account? Do they have a current reserve study? If the answer is “no” to either of these questions I would seriously questions the financial health and long term viability of the community. Failure to plan and save for replacement of infrastructure will usually result in poor maintenance and special assessments.

Living in a condo or HOA community can be a great experience with amenities and a sense of community that you won’t find anywhere else. But some people just aren’t cut out for “HOA life” and all communities are not created equal, so do your research and don’t overlook the red flags.

- Liar, Liar, Pants on Fire! Handling Misinformation in Your HOA - March 13, 2019

- Setting the Ground Rules for Neighbor Disputes - June 27, 2018

- HOA Board Responsibilities – It’s Not as Difficult as You’re Making It. - April 23, 2018

Help

Help

The last three years’ of minutes and financials are great documents to recommend.

HOA and Condominium and Co-op state rules differ from state to state, as does licensure for association managers, so don’t depend on anybody else’s experience, even your own. Money is at the heart of all CICs’ operations, and if you don’t pay attention to these, you may find assessments being paid for reserves and maintenance, when reserves are treated like a board’s piggy bank, and there are no annual maintenance plans.

Every set of CC&Rs and By-laws are unique and individual, and if you don’t do your own due diligence, marks on you.

A realtor **is not** interested in helping you with this level of due diligence, generally.

Great points, Sadly many home buyers don’t even review the basic documents not to mention requesting additional documentation (beyond a standard due diligence package). When buying a Condo/HOA. Just a little extra effort – like reviewing 3 yrs financials and minutes – can reveal those “red flags” that might otherwise be missed.

Hopefully the minutes aren’t a word for word dictation of meetings or that could take a while 😉

Excellent article! Homeowners considering purchasing in a community association should read and consider the points above. A few other indicators of an Association’s health are accounts receivables, and history of special assessments.

Thanks Tyler, great points! Accounts receivable and past special assessments can be a great indicator of financial health.