by Robert Nordlund, PE, RS | Feb 7, 2019 |

Excerpt: The Boy Scout motto, “be prepared” is sage advice for HOAs too. You know adequate reserves are a must, but what the heck does “adequate reserves” mean, and how can you make sure yours are up to snuff? Read More...

[et_social_share]

by Ashley Lipman | Feb 21, 2018 |

At this point in time, so many people are taking advantage of sublets on Airbnb to make additional money. But this revenue generating method isn’t possible for HOAs. On the contrary, most homeowners associations frown upon tenants subletting their apartments on hospitality websites. But, is there a way for an HOA to make additional income? Read More...

[et_social_share]

by Burke Nielsen | Apr 6, 2017 |

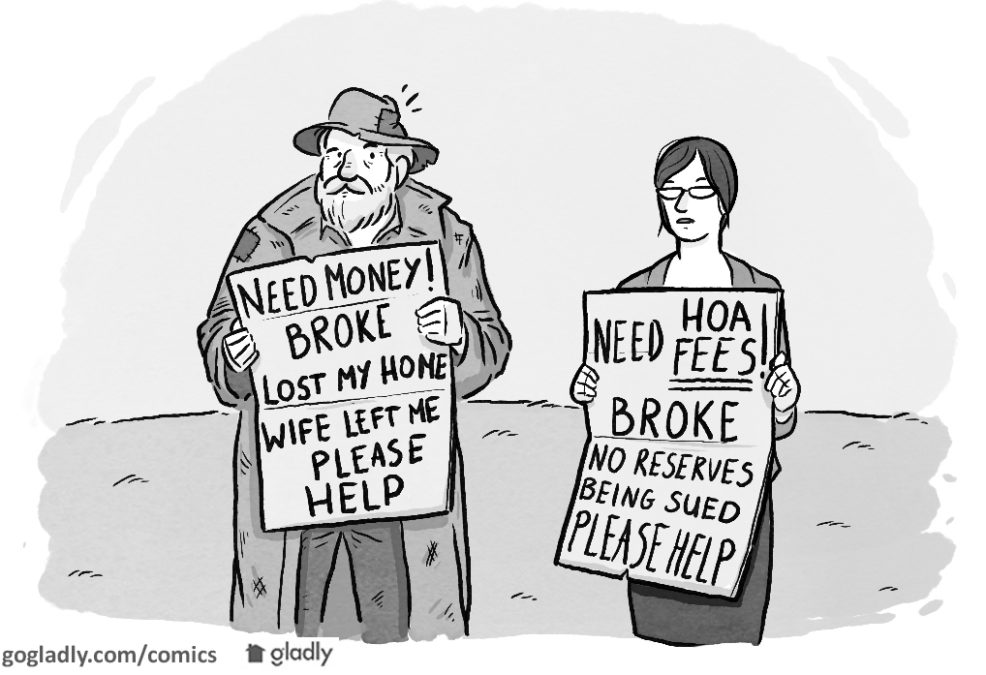

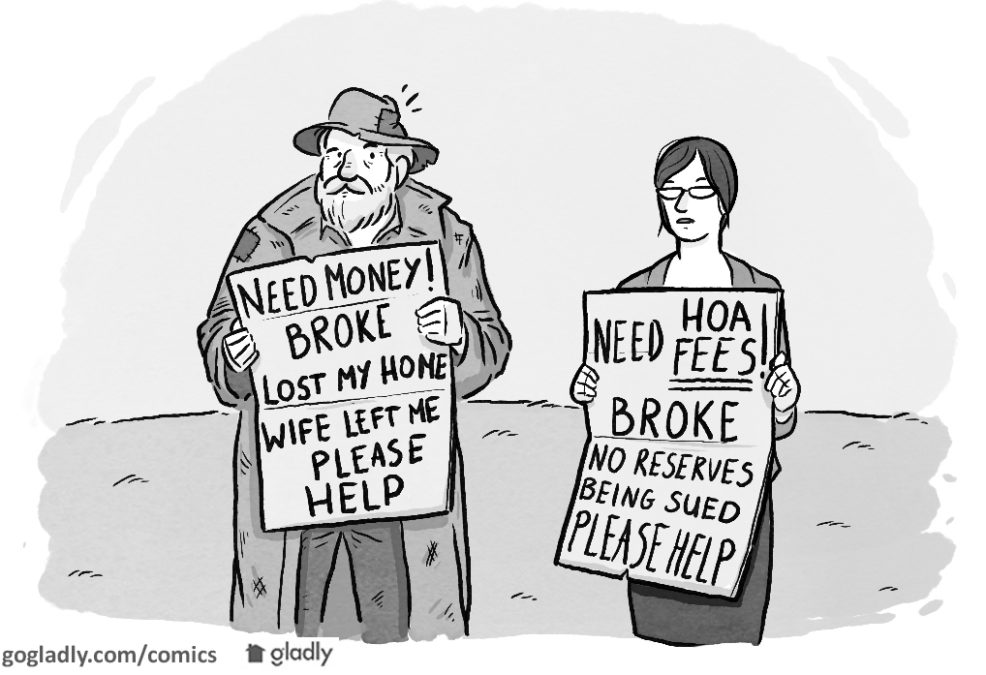

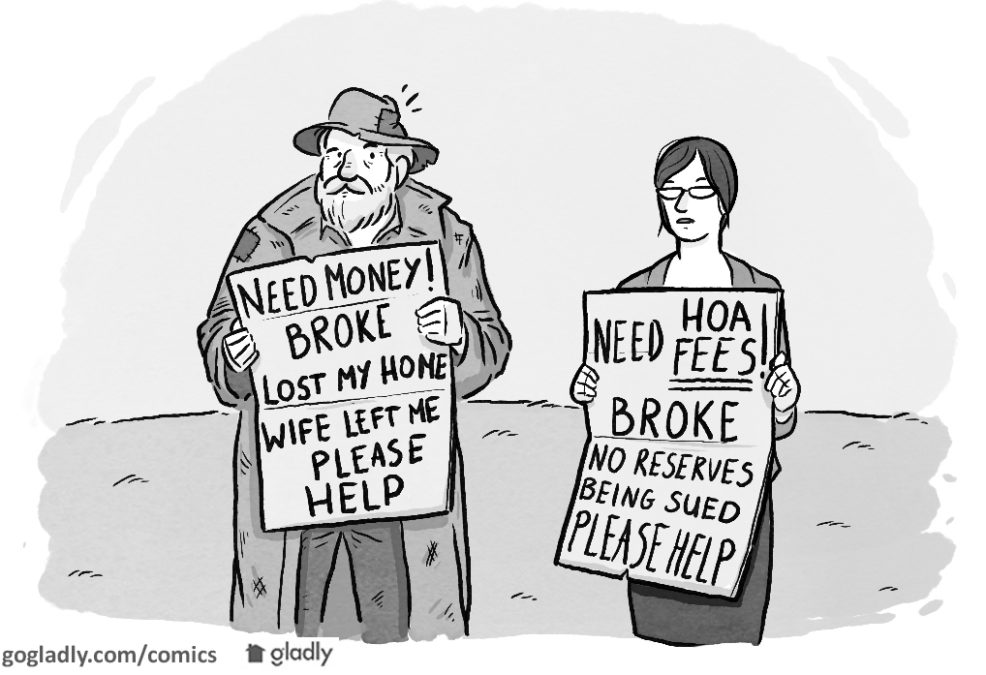

Nearly every homeowner in a condo or HOA has asked themselves at one time or another “What do the HOA fees pay for”. The answer is different for every community but the fact is the average homeowner doesn’t know where HOA fees are spent. Heck, you probably have a better idea where the homeless guy is going to spend the 2 dollars you gave him this morning. But every member of the HOA should know where the money is going — or at least be able to easily find out. Read More...

[et_social_share]

by Tina Larsson | Jan 26, 2017 |

Start with amenities that can bring in the most money to the association for the lowest up front cost. This way, the first added amenity can pay for the next one; and so on. Adding advertising in the form of signs or billboards can be revenue generators, but are not allowed in many residential areas. However, ATM machines bring in revenue, can be thought of as an amenity by some, and do not take up a lot of room. Read More...

[et_social_share]

by Tina Larsson | Sep 13, 2016 |

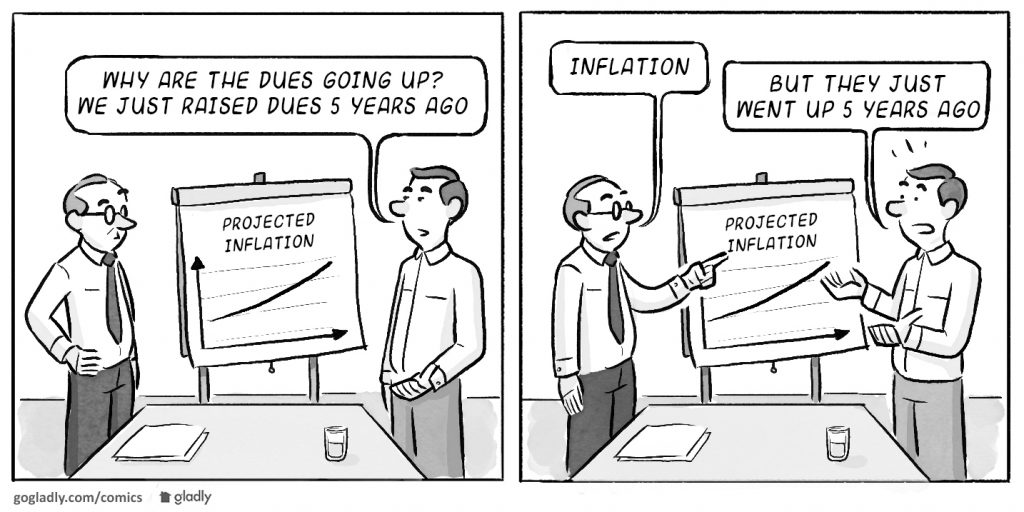

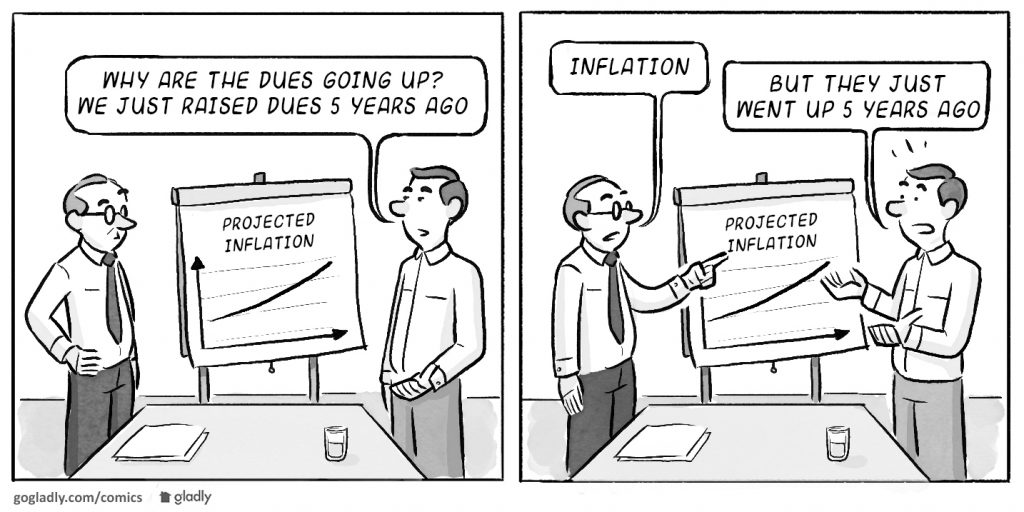

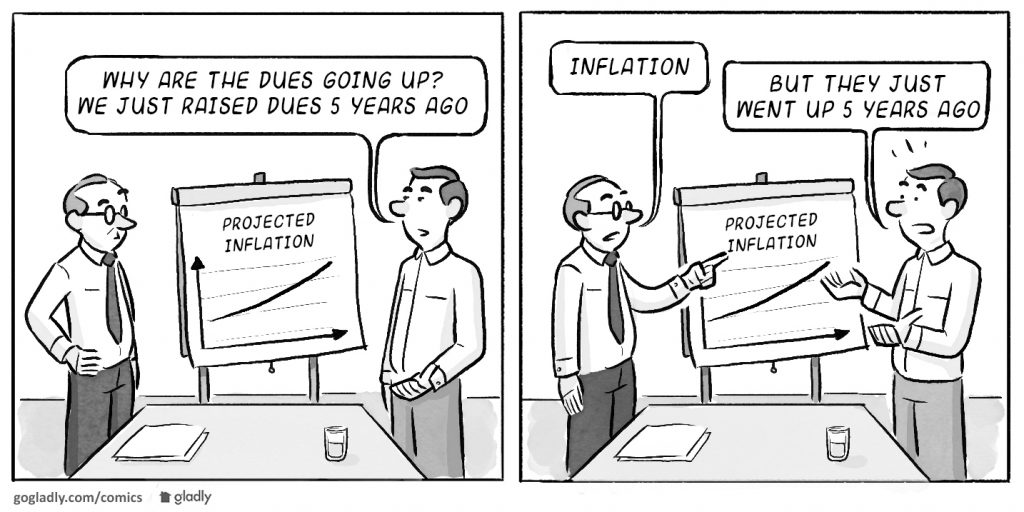

HOA Managers and Board Members are constantly struggling with increasing costs, which they have to pass on to HOA members. For this exercise, the reason why costs are increasing isn't that relevant. The important point to remember when it comes to increases is that they usually increase, on average, at a rate greater than inflation. Read More...

[et_social_share]

by Burke Nielsen | Aug 17, 2016 |

The problem with increasing dues every 6 years, is that the amount is usually so large that it becomes a big financial hit for most homeowners. When dues don't increase for a long time, many homeowners start to believe that dues should never increase. The way they see it, “the HOA was just fine up until now, so this 30% increase seems like an outrage” — and quite frankly they're right! Read More...

[et_social_share]

Help

Help