If the phrase “assessments are the lifeblood of a community association” passed your lips at the last board meeting, you either have 1) a puzzling penchant for perplexing prattle (what?) or 2) your HOA collection policy isn’t keeping up with costs, resulting in painful financial straits.

Either way, you have a problem.

As you well know, an HOA can’t function without a reliable stream of income, and that money only comes in if residents pay their monthly assessments. Sadly, the world is full of loose cannons. You know… human beings with mortgages, car payments, illnesses, and lives that sometimes get in the way of paying their HOA dues. However legitimate the cause, when a portion of HOA income becomes sporadic, irregular, or goes missing altogether, your HOA collection policy comes into play.

How Good is Your HOA Collection Policy?

A uniform, even-handed HOA collection policy is vital to your community’s long-term success. The good news is if your policy is well-drafted by a qualified attorney — and you stick to that policy in collecting late payments — homeowners usually comply relatively quickly. A well-drafted HOA collection policy should lay out:

- That delinquent payments will not be tolerated

- What procedures the HOA will follow in the event fees aren’t paid

- That there is a financial consequence for late or unpaid fees

- What those consequences are, and at what intervals they will come into play

Most homeowners are reasonable people. And reasonable people tend to place higher priority on paying their fees once they understand the policy. Fortunately for you, the need for formal collection action is relatively rare in most communities (especially with automatic payments).

Under some circumstances, an HOA may work out a payment plan or other solution with a homeowner – but this should be kept strictly confidential, and should be done in harmony with any applicable by-laws or HOA policies.

- The Pesky Nuances of the HOA Collection Policy - July 26, 2017

- HOA Legal Costs — Who’s Running Up The Bill? - October 19, 2016

- HOA Records — Save or Shred? - September 8, 2016

Help

Help

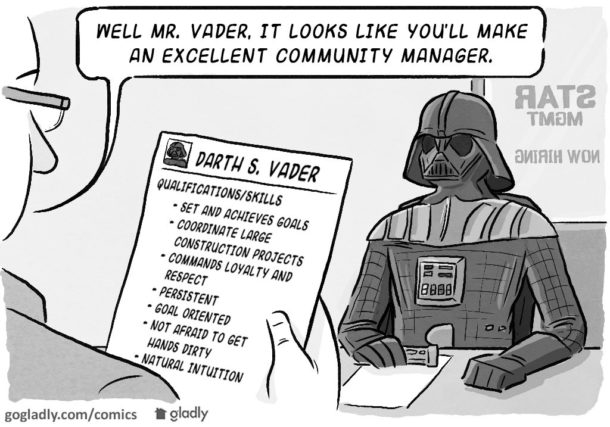

This is well said and the comic is hilarious!

Thanks for sharing. I can share some useful information about hoa collections.