by Craig Huntington | Apr 6, 2016

With the recent stress in the financial market, many boards and property management companies are beginning to more closely monitor the insurance of their funds. For many years now, leaders in the HOA banking and auditing industry have stressed the importance of following established laws and adhering to their fiduciary responsibility that governs the insurance of these funds, and the recent financial stresses further emphasize this need. One of the most widely accepted and valuable tools for ensuring full insured funds are a program called CDARS. Read More...

[et_social_share]

by Khirzel | Mar 31, 2016 |

While technology has many advantages, the internet and social media has led to a decline in human interaction between neighbors. For as little as $0.99, anyone can create a website. Many homeowners associations are behind the times and have not yet created their own HOA website, let alone registered for a HOA website domain name. Accordingly, when neighbors are not neighborly, and tempers flare, the creation of a dissident website (fake HOA website) using the name of the homeowners association is becoming an increasing popular way for members to voice their dissatisfaction. What should a homeowners association do when this happens? Read More...

[et_social_share]

by Victoria Cohen | Mar 23, 2016 |

The purchase and annual renewal of the Master Insurance policy for most homeowner associations (HOAs) is probably the quickest and least understood decision an HOA board makes each year. Lincoln Cummings of Cummings & Associates related a story about board members who unlawfully approved a reduction of insurance coverage, to save money, before a catastrophic fire caused $1 million more damage than the reduced policy covered, which resulted in a $100,000 personal judgement, on appeal, against each board member. Protect yourself, and protect your association, by hiring a qualified insurance broker who can advise your community based on the needs, trends, and threats that exist for your distinctive community, and then follow their advice. Read More...

[et_social_share]

by Harvey Radin | Mar 16, 2016 |

Not surprising that in a random sample of newspaper and TV stories focusing on HOAs and condo associations, 13 of 16 stories were about disputes and controversies. Only 3 stories were positive.The news media love controversies. And why wouldn't they? Controversies attract readers and viewers like poop attracts flies. So you can bet if there's some controversy brewing in your association, a newspaper or TV reporter just might come knocking on your door. And it's not fun when that happens. Read More...

[et_social_share]

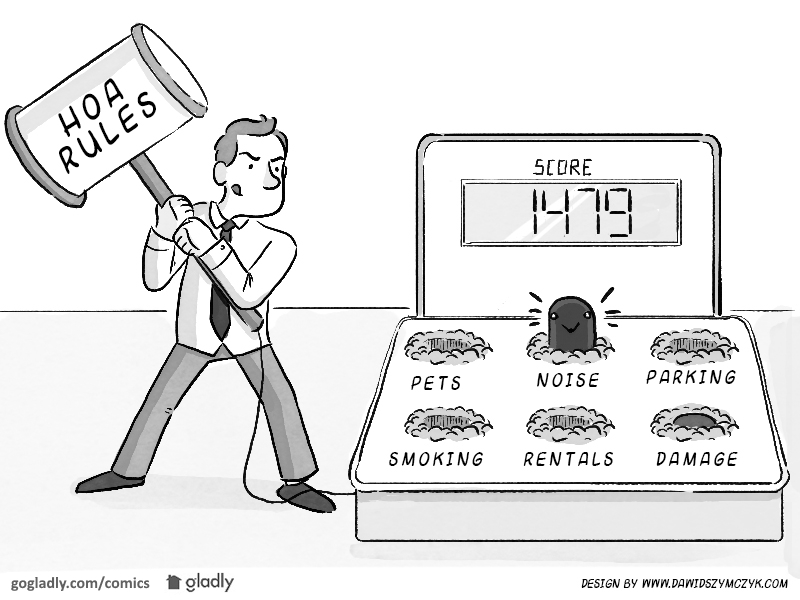

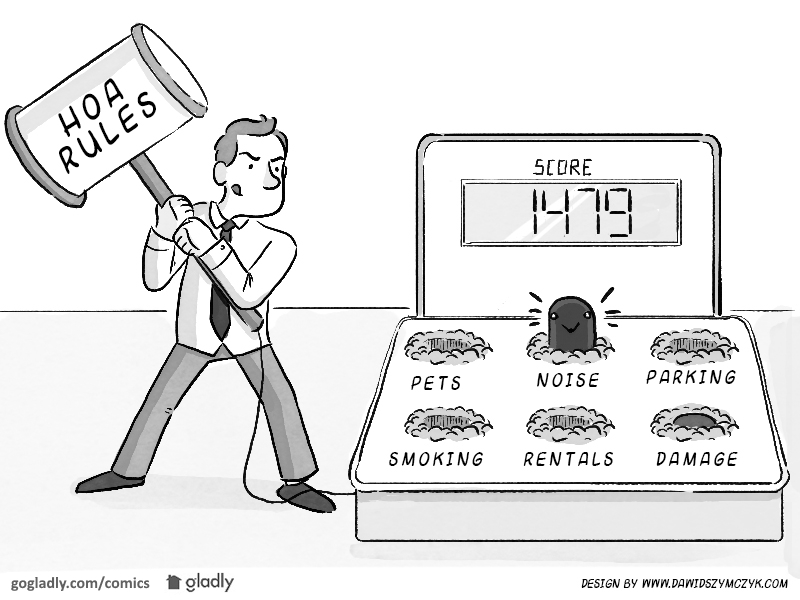

by Burke Nielsen | Mar 9, 2016

You’ve read the news stories about the homeowner who was treated unfairly by their HOA. In fact, if you’ve worked in the industry you may have witnessed it first hand. Whether these stories are valid or just fodder for a good news story, is a discussion for another blog post — But as a CAM manager, I found myself talking the HOA board out of creating unreasonable or unlawful HOA rules on more than one occasion. Read More...

[et_social_share]

by Alan Crandall | Mar 3, 2016 |

Every company needs clients. Without clients, well, you don't have a business. But is the customer always right? Most of the time yes, but there are times when the best course of action is to “kick the bums out”! Yes, I said it! Even if they are profitable! You know who I'm talking about — Clients that take up an inordinate amount of your time. Ones that always complain about costs. The ones that treat you and your staff without respect. Especially the ones that generate the least amount of revenue. Read More...

[et_social_share]

Help

Help